Vat Invoice

If the transaction involves an intra-Community supply of goods the invoice must be provided by the 15 th day of the. In some countries you cant get a VAT invoice or receipt if you didnt enter your tax ID number before you made the purchase.

Managing Invoices Whilst Waiting For Vat Registration Inniaccounts

Contains the words Tax Invoice VAT Invoice or.

. Get Started For Free. The names and addresses of both service partners must. As from 8 January 2016 the following information must be reflected on a tax invoice for it to be considered valid.

UK VAT invoices must be issued within 30 days of the taxable supply. VAT invoicing rules consider it a violation of the act. Basic principles of the EU-wide rules.

The Irish VAT system requires taxpayers to submit invoices to support claims for input VAT deductions. A properly prepared invoice usually has to include the following information. A VAT invoice is used when selling goods with an added VAT tax.

Ad Complete Any PDF Form Online Send It by Email Fax or Print. The VAT number of the VAT-liable supplier as well as a reference to applicable provisions of. A simple invoice can be issued if the transaction amount is less than EUR 150.

Create and print WooCommerce VAT invoices with BizPrint. Paragraph 163 sets out the information you need to show. Requirement for the invoice without VAT.

Theres no requirement to issue a VAT invoice for retail supplies to unregistered businesses. VAT-registered businesses in Ireland are required to issue VAT invoices. Perhaps one of the most difficult financial systems to understand in the world is the taxation system of a country.

Restaurants grocery stores boutiques and supermarkets are just. Ad Invoicing Made Simple. A VAT invoice is a document containing certain information about what youre supplying.

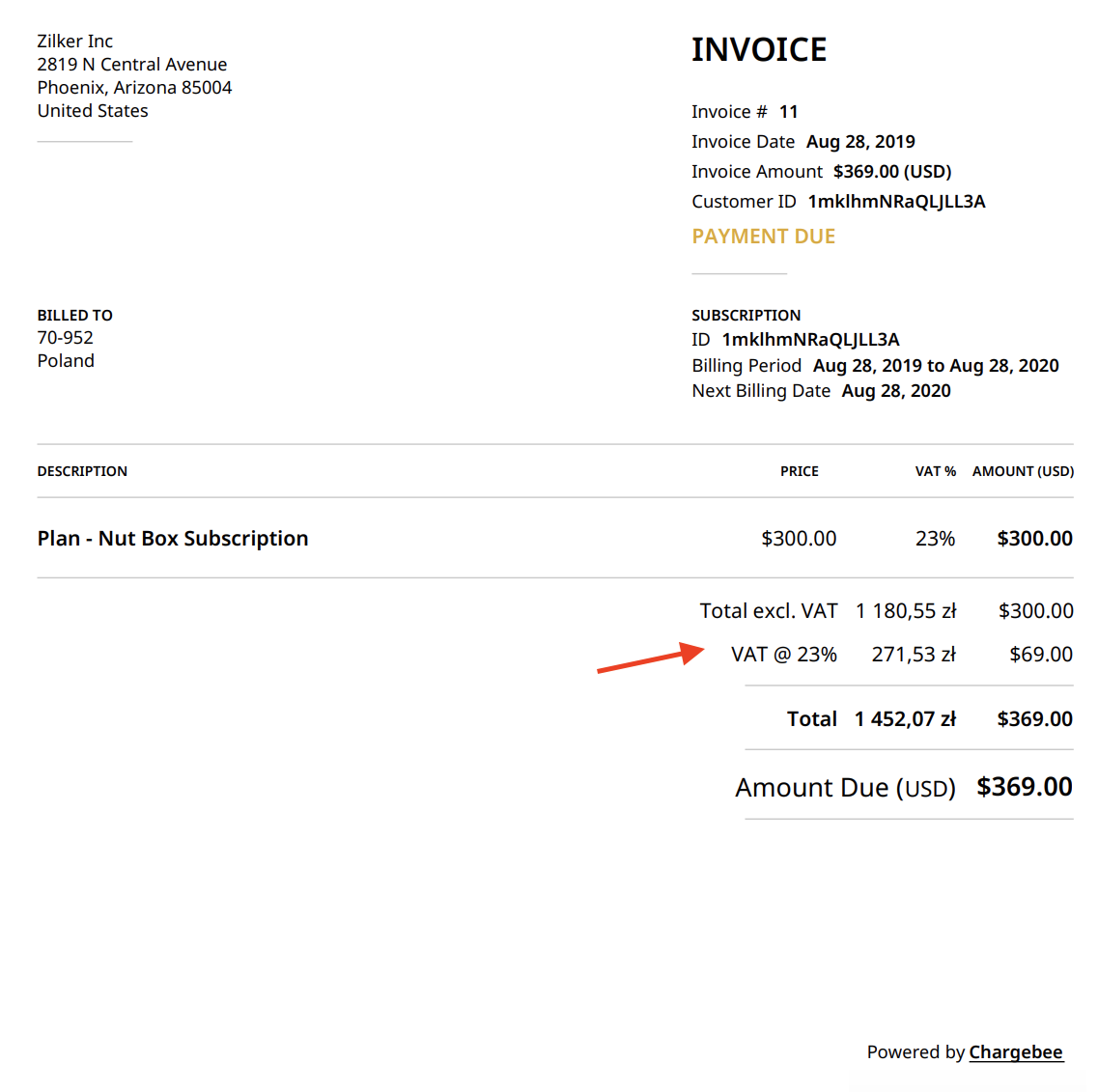

A detailed VAT invoice is often for merchants and wholesalers managing higher amounts of taxable supplies. It contains the details of goods services and taxes. Get Started For Free.

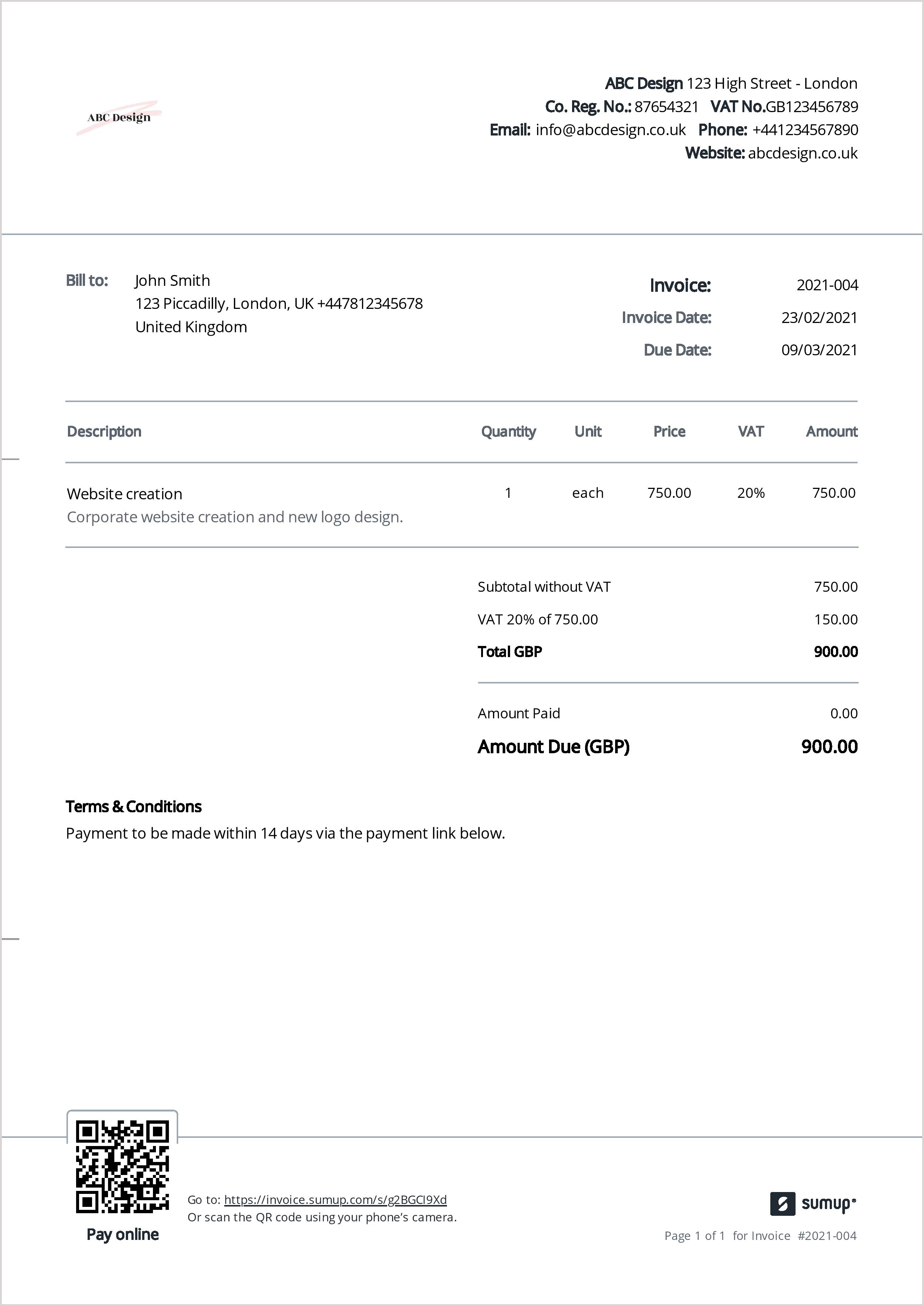

Create and send a VAT invoice in less than a minute with SumUp Invoices. Electronic invoices are equivalent to paper national tax authorities cannot require businesses to provide. Save On Time Taxes And Get Organized For Less Than 2 Per Day.

The VAT invoice is for countries that require businesses to pay a value-added tax for goods that exchange from one 1 party to. As a retailer you may assume that no. Save On Time Taxes And Get Organized For Less Than 2 Per Day.

All-in-one PDF Editor Doc Generator. Create Send Customized Invoices Track Expenses More. The EU rules can be found in the VAT Directive.

54 VAT invoices issued by retailers. Click on the transaction you want an invoice for. BizPrint is an all-in-one plugin designed to help automate the creation and printing of WooCommerce invoices.

A VAT invoice is a specific type of invoice thats issued when a sale is subject to sales tax. Spend Less Time On Invoicing and More Time Doing the Work You Love. In addition you must have the VAT identification.

A VAT invoice is a business document which contains details about the amount of Value Added Tax that is associated with the products that a business has sold to their. Tax invoices are invoices sent by registered dealers to the purchaser indicating the amount of tax due. Ad Limited Time Sale.

As per the VAT invoicing in KSA non-registered persons cannot issue a tax invoice or collect any VAT from the customers. A tax invoice allows. The VAT invoice templates are handy to all those individuals stores and shops that are liable to pay VAT to the Government.

As time goes on the government comes up with more and. For most countries outside the United States a VAT tax is a percentage of the value of a product or service when it is. Answer 1 of 4.

Create Send Customized Invoices Track Expenses More. Ad Invoicing Made Simple. 70 Off For 3 Months Plus 250 USD In Ad Credits From Microsoft.

The invoice must contain the VAT identification numbers of both parties and the indication that it is a reverse charge invoice. Only businesses that are. Start 30 Day Free Trial.

A VAT invoice in the UAE must contain this information in.

How To Get Nelio Content Vat Invoices

Template Of The Invoice Of The Vat Payer Tax Document Fakturaonline Rs

What Are Vat Invoices And Who Needs To Issue Them Sumup Invoices

What Is A Vat Invoice Charging Value Added Tax To Eu Clients

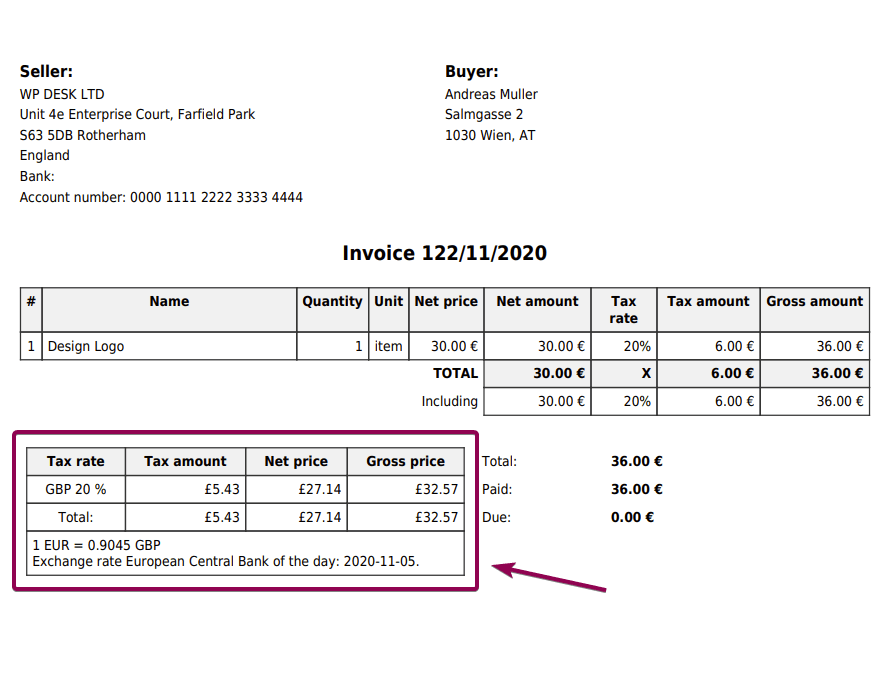

Woocommerce Eu Vat Assistant Invoicing Flexible Pdf Invoices

Template Of The Invoice Of The Non Payer Of Vat Fakturaonline Rs

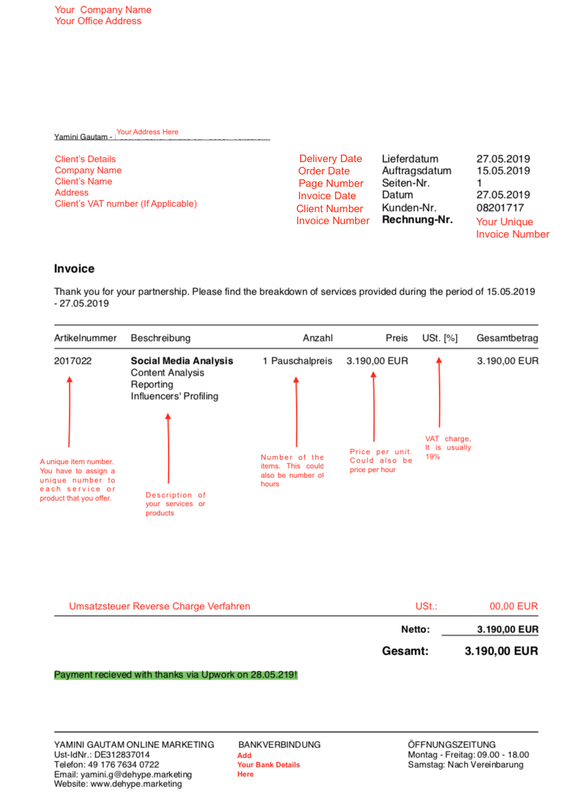

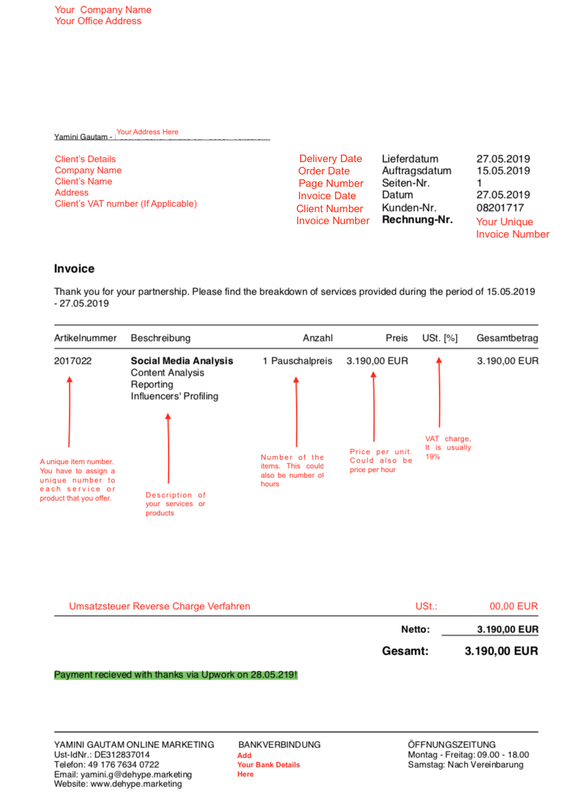

How To Create German Vat Invoice Free Invoice Templates Mademoiselle In De

Invoice Without Price With Vat Issue 1364 Thirtybees Thirtybees Github